2025 Real Estate Wild Cards: What Could Shake Up the Market?

The 2025 housing market is shaping up to be an interesting one—steady growth, more inventory, and a bit of breathing room for buyers. But let’s be real: behind every steady forecast lies a handful of wild cards that could shift the game. From unexpected mortgage rate swings to federal policies that

Read MoreHow the 2024 Presidential Election Might Affect the Housing Market

No matter how many elections you’ve lived through, each one can feel a bit like a wildcard when November draws near and you’re wondering whether you should make a move—or wait until the dust settles. Generally speaking, presidential elections have only a small and temporary impact on the housing m

Read MoreReal Estate vs. Stocks: The Ultimate Long-Term Investment Showdown

When it comes to long-term investments, Americans have a clear favorite: real estate. According to a recent Gallup poll, 36% of Americans believe real estate is the best long-term investment, outpacing stocks (22%), gold (18%), savings accounts (13%), bonds (4%) and cryptocurrencies (3%). Why i

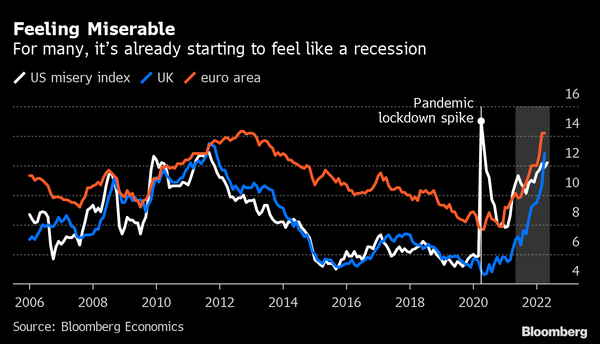

Read MoreWhat a recession could mean for the housing market

A recession is defined as "a period of temporary economic downturn during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters." In other words, it's when the economy takes a turn for the worse. Recessions can last for months or even year

Read MoreWill Home Prices Continue to Rise? Experts Predict What's Ahead for 2023.

It's no secret that home prices have been on the rise in recent years. But what does the future hold? Will prices continue to go up? Or has the market reached a tipping point? We asked some of the top real estate experts to weigh in with their predictions for what's ahead in 2023. Here's what they h

Read More

Categories

Recent Posts